Fees are a boon for those who charge them, and a noose for those who pay them.

Driving the news: Two Grayscale crypto trusts, its bitcoin (GBTC) and ethereum (ETHE) boxes, charge shareholders 2% and 2.5%, annually, respectively.

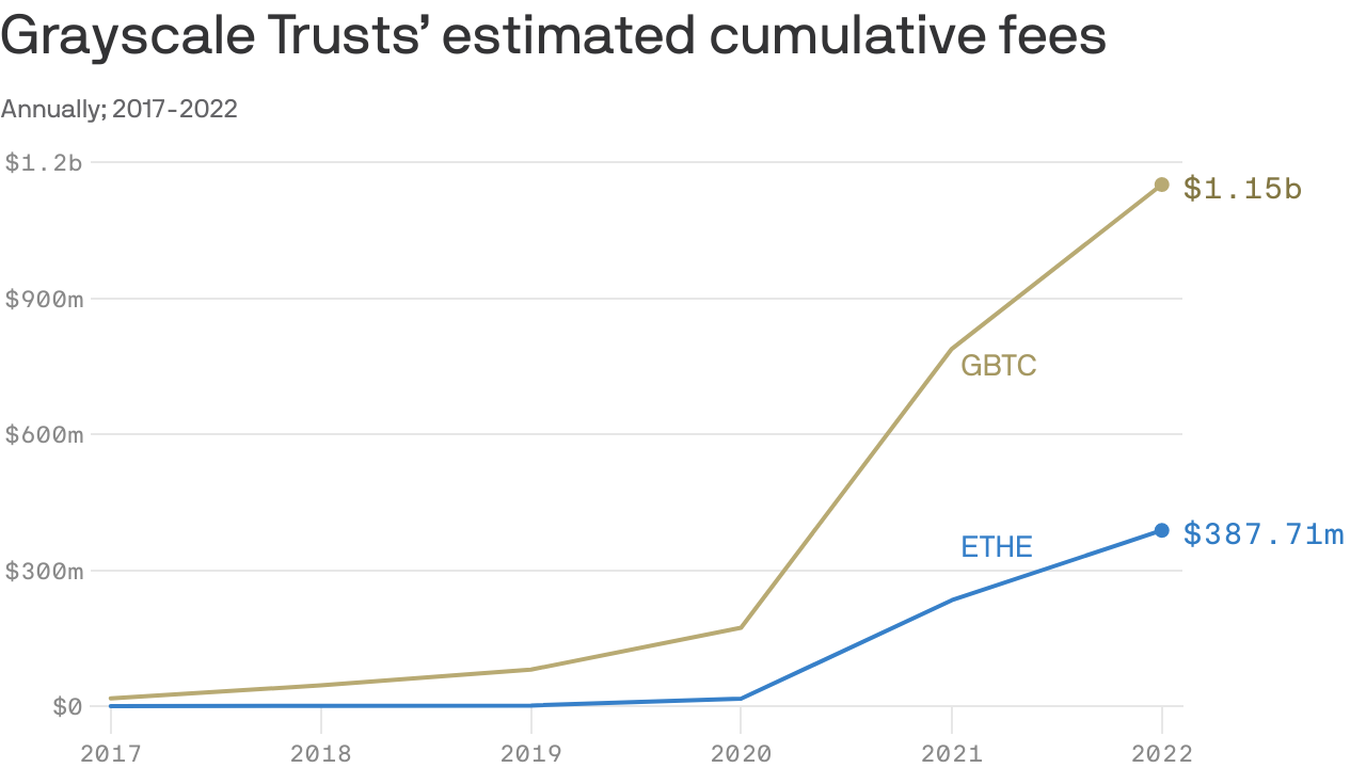

- Over the lifetime of both of those products, investors have paid an estimated $1.2 billion for GBTC and $387 million for ETHE cumulatively, according to Morningstar Research.

- The data assume current annual fees since GBTC started three years before ETHE kicked off in 2017.

Of note: See how those fees rose as a percentage of assets during the start of the most recent crypto bull run in 2020.

Yes, but: If Grayscale were able to convert the trust to a spot bitcoin ETF, fees should be reduced, though that’s unlikely in the near term.

- Recall Grayscale is suing the Securities and Exchange Commission for its decision to deny that application.

The bottom line: That steady, more predictable income stream puts Grayscale on more solid ground than its sister units under parent company Digital Currency Group.